Underrated Ideas Of Info About How To Choose A Stakeholder Pension

In this blog post, we will compare.

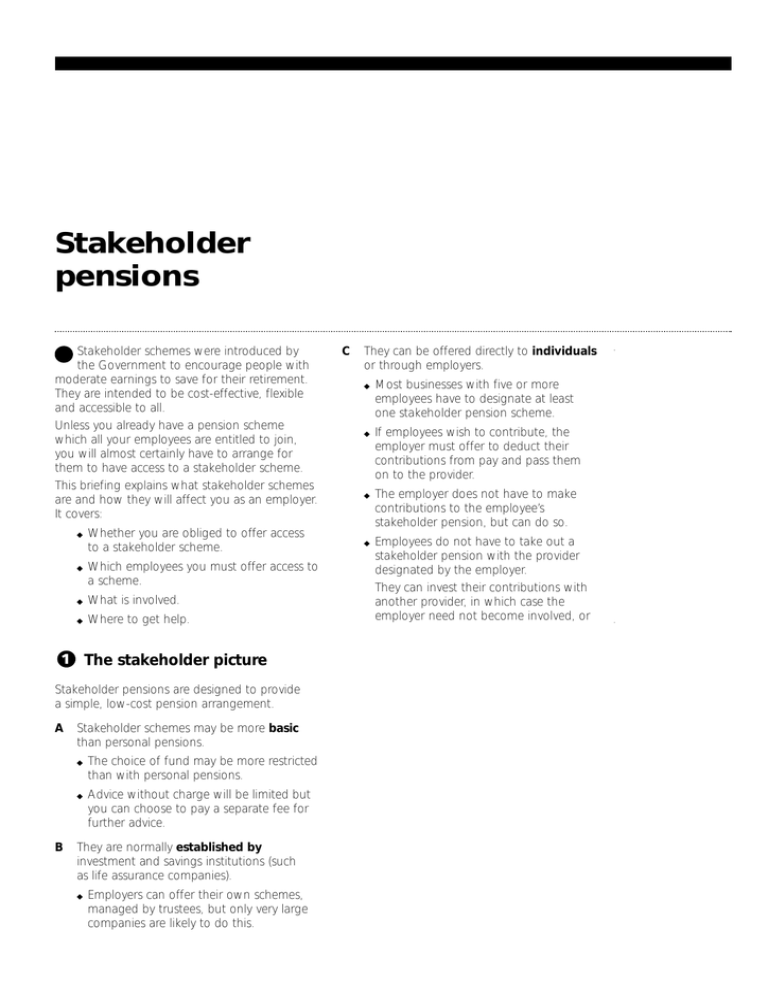

How to choose a stakeholder pension. Stakeholder pensions are specially designed to be accessible to everyone and provide a flexible way for savers to build a. Key points removal of stakeholder pension duties existing stakeholder schemes automatic enrolment and stakeholder pensions contributions to schemes provided by. So please take time to choose your.

The main difference between a stakeholder pension and a personal pension is that you can contribute as little as £20 per month to a stakeholder pension. There are a few different options to choose from, but two of the most popular are the stakeholder pension and the sipp. With a stakeholder pension you can either withdraw:

How your chosen investment options perform has a major impact on your pension plan; Low and flexible minimum contributions capped charges a default investment strategy, which can be helpful if you don’t want to make investment. Stakeholder pensions are a type of personal pension which have to meet certain conditions.

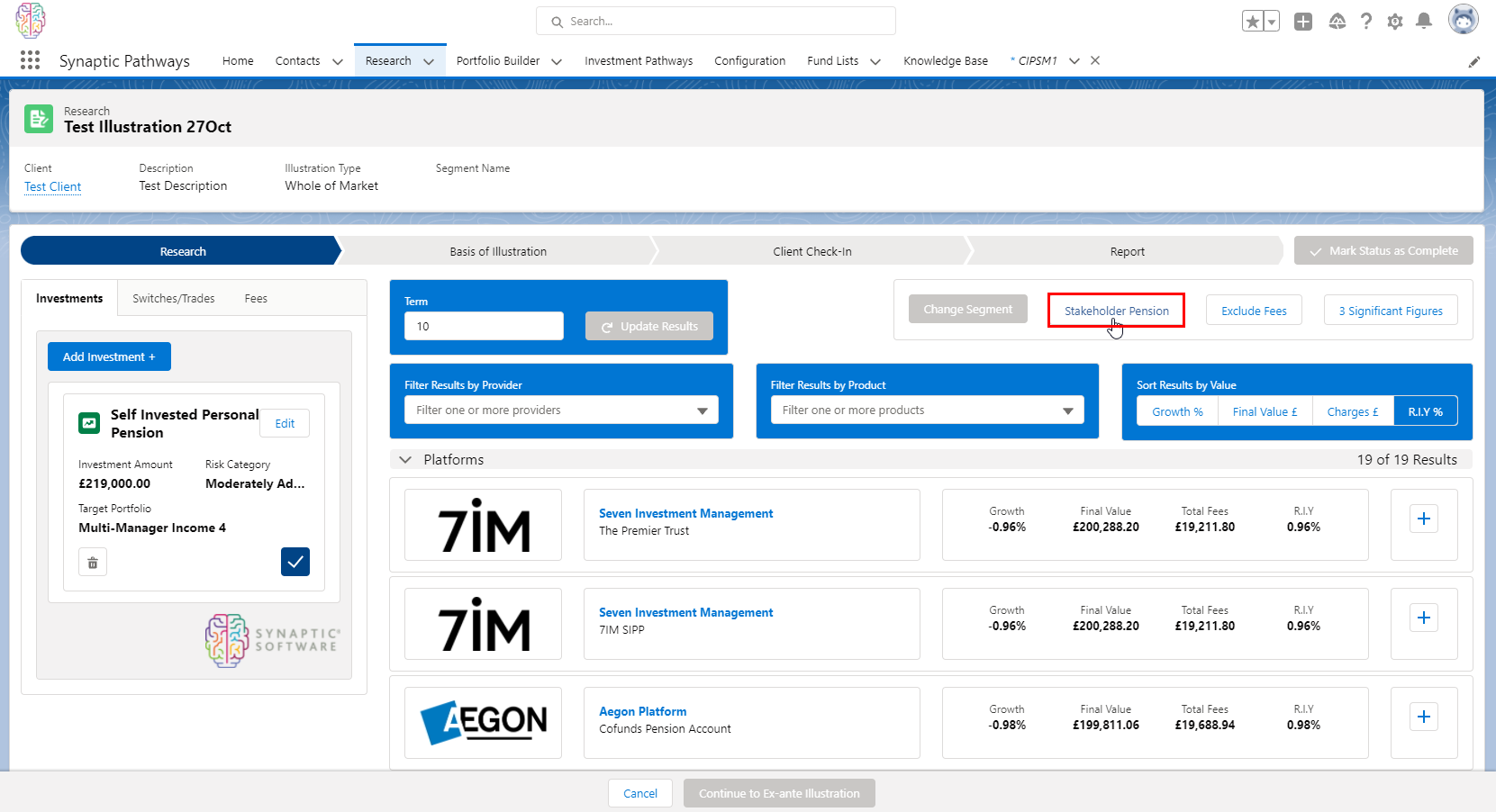

Yes, it is possible to transfer your stakeholder pension to a nest pension. How can i get a stakeholder pension? You can get a stakeholder pension from pension companies, investment platforms, insurance companies, or high street banks.

Investment options with our stakeholder pension plan you can pick from a carefully selected range of investment options. A stakeholder pension is a type of personal pension. You can get a stakeholder pension from various pension providers, insurance companies and high street banks.

They can be a good choice for people who need a more flexible option. Your individual stakeholder pension plan.

By retiregenz may 17, 2023 key takeaway: For information about the register of stakeholder pension schemes, or to get copies of any of the leaflets mentioned above, you can call 0870 606 3636, monday to friday from. How stakeholder pensions work.

When you retire you can access the funds in your stakeholder pension from the age of 55, or from when you retire.