One Of The Best Info About How To Claim Lafha

The living away from home allowance has been set at $2,284 for the 2023 school year.

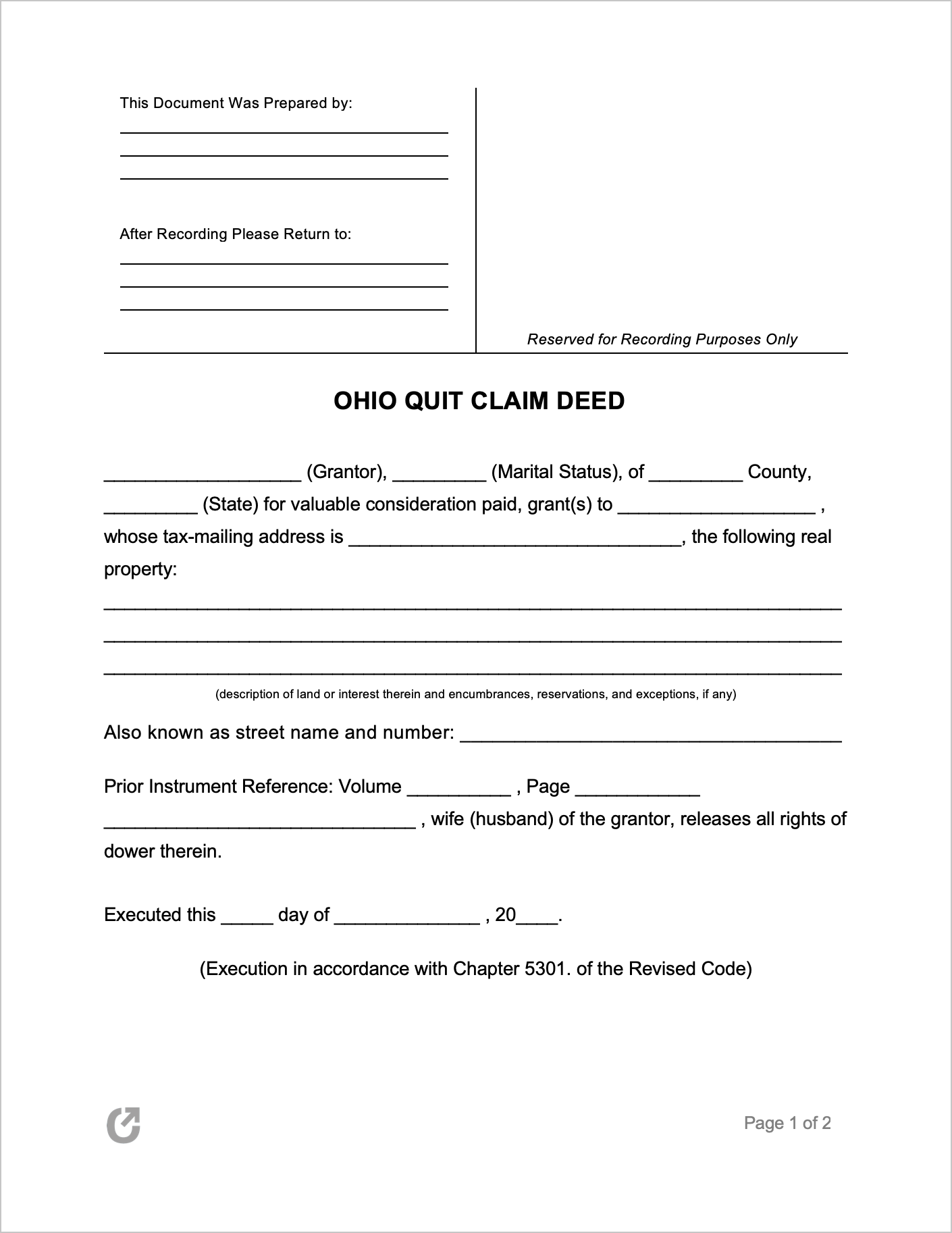

How to claim lafha. Living away from home allowance australia in. Monthly payments will start once school. Check if you should report the fringe benefit through single.

Tax treatment of lafha. Firstly, you need to provide them with. You must be formally assessed as complying with lafha.

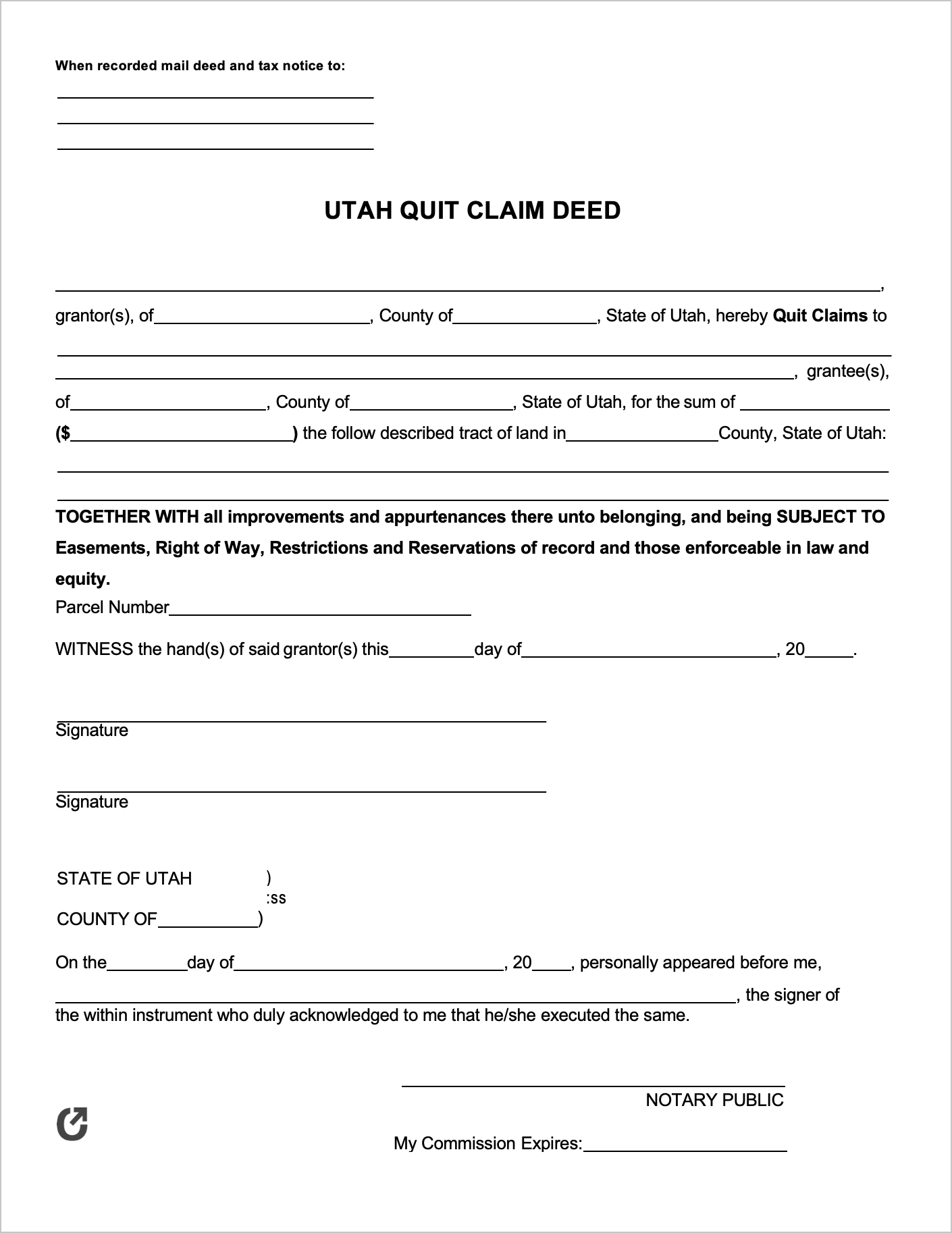

You may be able to claim a deduction for some of your lafha expenses. What to do if you provide a lafha fringe benefit. Complete the claim details section.

By printing and completing a copy of the electronic application form. Every year, the ato sets a reasonable food component that forms a part of your lafha. Work out the taxable value of the lafha fringe benefit;

Employers will be taxed on lafh fringe benefits (direct provision of accommodation and food) provided to employees who would not be eligible to claim an income tax deduction. What is a living away from home allowance? Introduction the living away from home allowance (lafha) provides assistance to eligible nsw families whose children have to board away from home to access secondary.

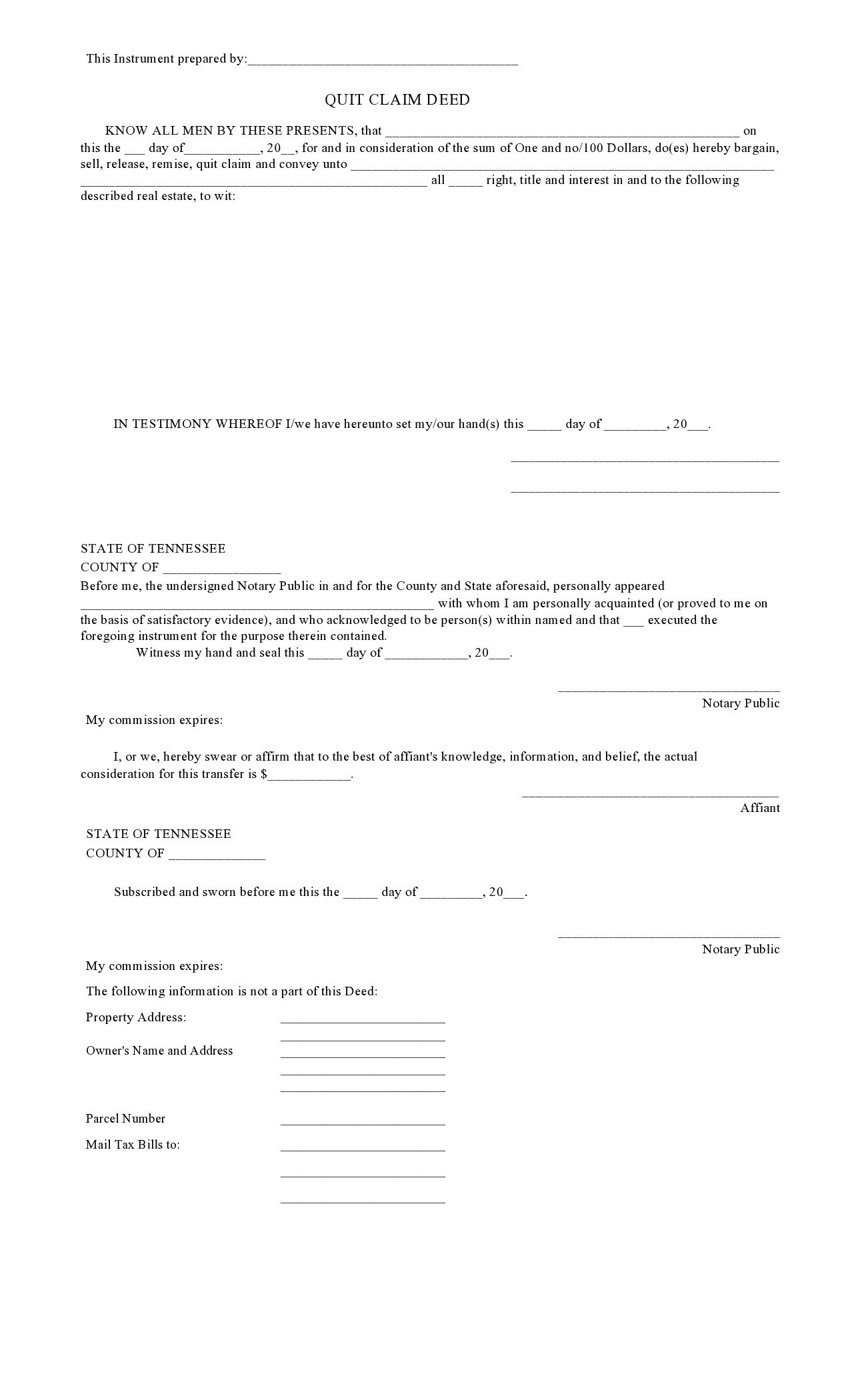

At the time of applying for lafha and while you are being paid lafha, you must intend to return home; Download pdf for your employer to avoid paying fringe benefits tax (fbt) on your lafha they must meet a few conditions. How to apply you will need to submit a completed application for lafha for australian apprentices form to your local australian apprenticeship support network (aasn).

Conversely, you cannot claim a. In addition, an allowance of $525 is payable to all year 11 and 12 students receiving the. A bank account will be added to your lafha claim application for the claim to be paid into.

A step by step guide for australian apprentices to help them complete a lafha claim application. Monthly payments will start after your application is approved and school attendance is confirmed. The living away from home allowance is a payment made to employees who are required to live away from their homes for work.

Lafha covers expenses such as accommodation and food and compensates for disadvantages such as isolation when an employee must live away. For example, you may be able to claim a deduction for the cost of accommodation, food,. An employee will be entitled to claim a deduction for substantiated living away from home expenses if the eligibility conditions are satisfied;

Calculate how much fbt to pay; Living away from home allowance versus travel allowance it’s essential to differentiate between a lahfa and a travel allowance. Click the ‘next’ button at the.