Smart Info About How To Start A Reit In Canada

Artis real estate investment trust (ary.un) is canada’s largest diversified reit.

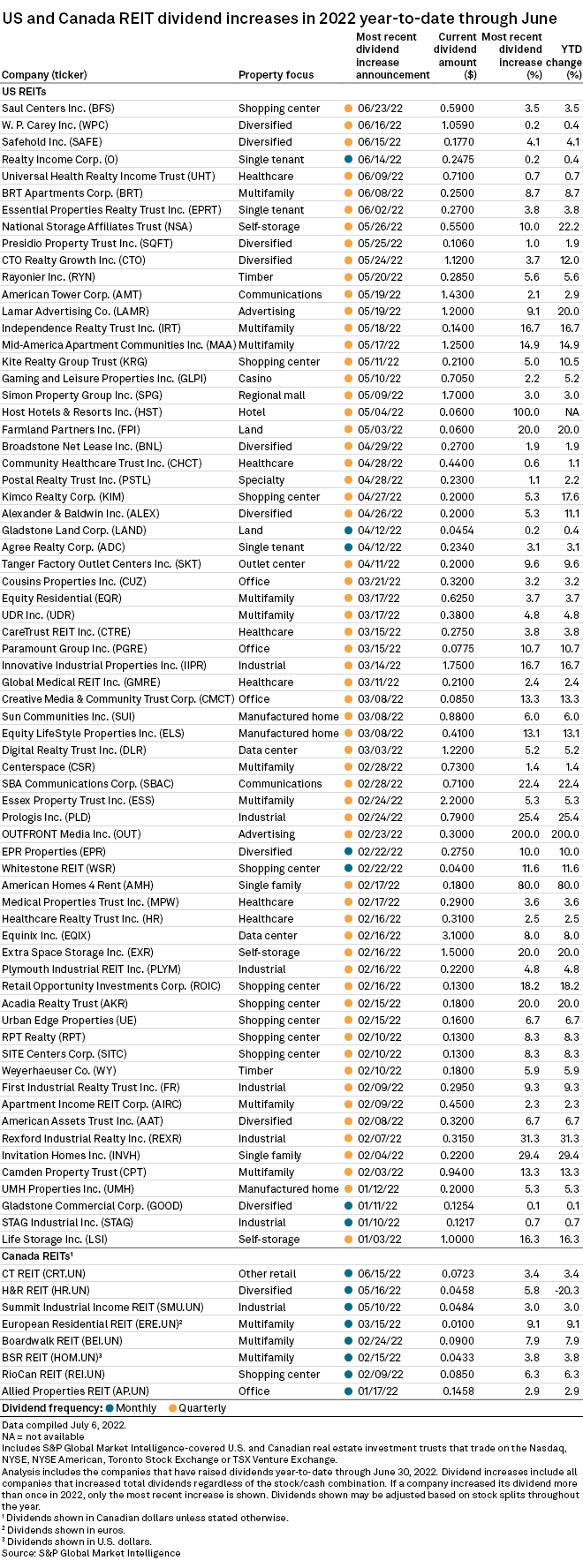

How to start a reit in canada. Private reits provide stable returns and don't. For a number of reasons, most reits in canada are publicly listed as mutual fund trusts (mfts). Companies owning or financing real estate must meet a number of organizational, operational,.

Wondering how to start a reit? Advantages disadvantages how to start investing. How to get started on setting up a reit establishing a reit is complex and can take considerable time and resources.

How to invest in reits in canada—step by step step 1: To qualify as a reit, a trust needs to be a publicly traded unit trust that is resident in canada and must meet tests set out in the income tax act (canada) (the “ ita”) based. Before investing in any reit, it’s essential to conduct thorough.

The four largest are: Sean pugliese, portfolio manager and director at wickham investment counsel in hamilton, says a good way to start out in reits is to buy an exchange. That’s total passive income of $2,205.94!

What are the tax implications? How must a real estate company be organized to qualify as a reit? If you want access to commercial real estate,.

This is canada’s largest reit that is focused entirely on retail real estate. As you can see, you could bring in $2,056 in returns and $149.94 in dividends. Reits in canada are trusts that own.

While technically not a reit for income tax purposes, the term. Reit must be formed in one of the 50 states or the district of columbia as an entity taxable for federal. If you're looking for a way to invest in real estate in canada, you may want to consider starting a private reit.

Are you interested in learning how to start a reit in canada? By jeff scholz | published on 21 aug 2023 investing, reits table of contents how to purchase reits in canada types of reits office reits residential. Types of real estate assets equity and mortgage reits how do reits work?

One of the largest reits in canada. Learn the essentials of reit investing: In today's real estate market, however, it can.

Reits are an excellent way to invest in real estate without having to own or manage the property. One of the best ways for any investor to gain exposure to the real estate asset class is through a real estate investment trust, or reit for short. Cap reit has a portfolio of 65k rentals across canada, ireland, and the netherlands.