Best Of The Best Info About How To Buy A Treasury Bill

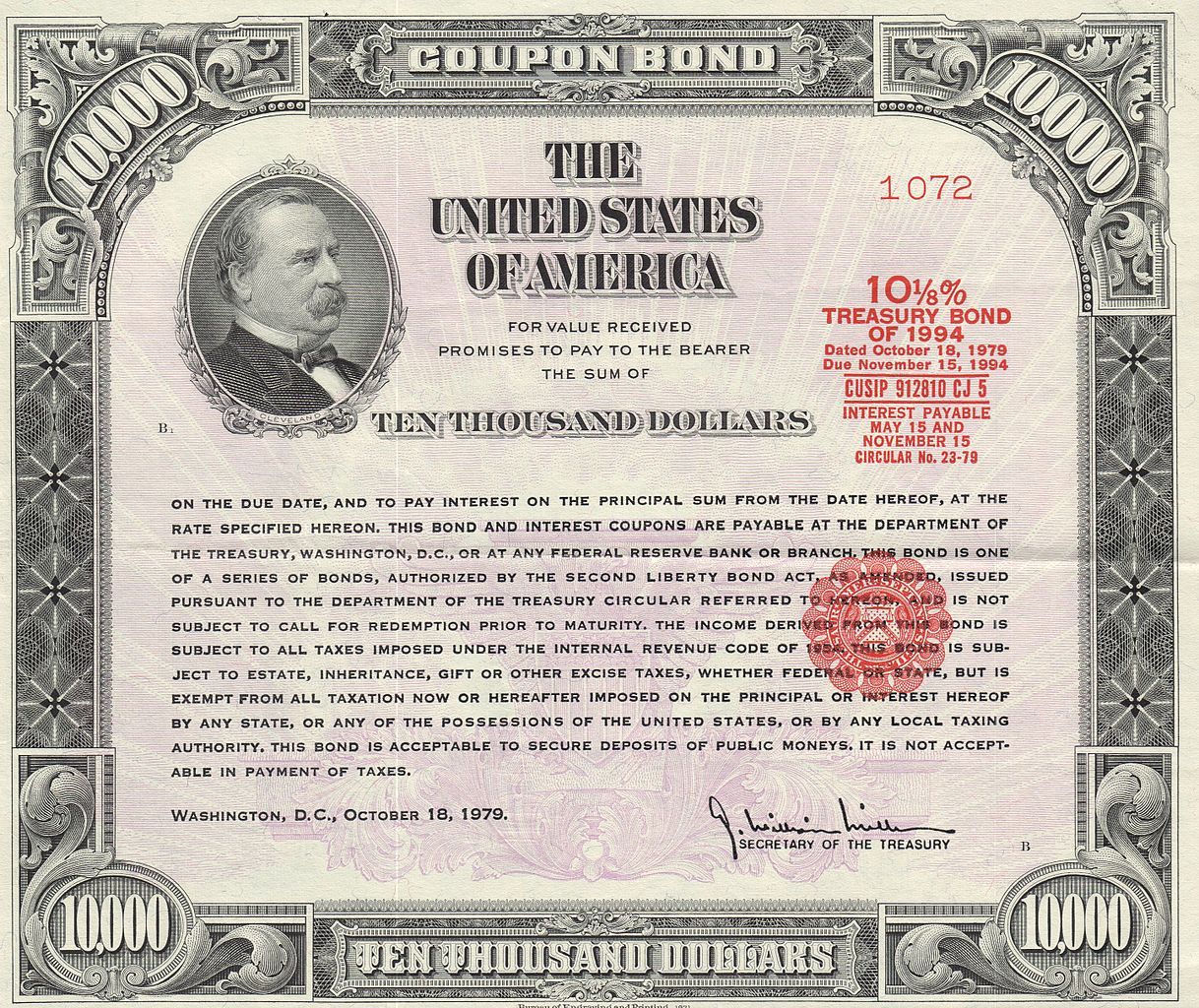

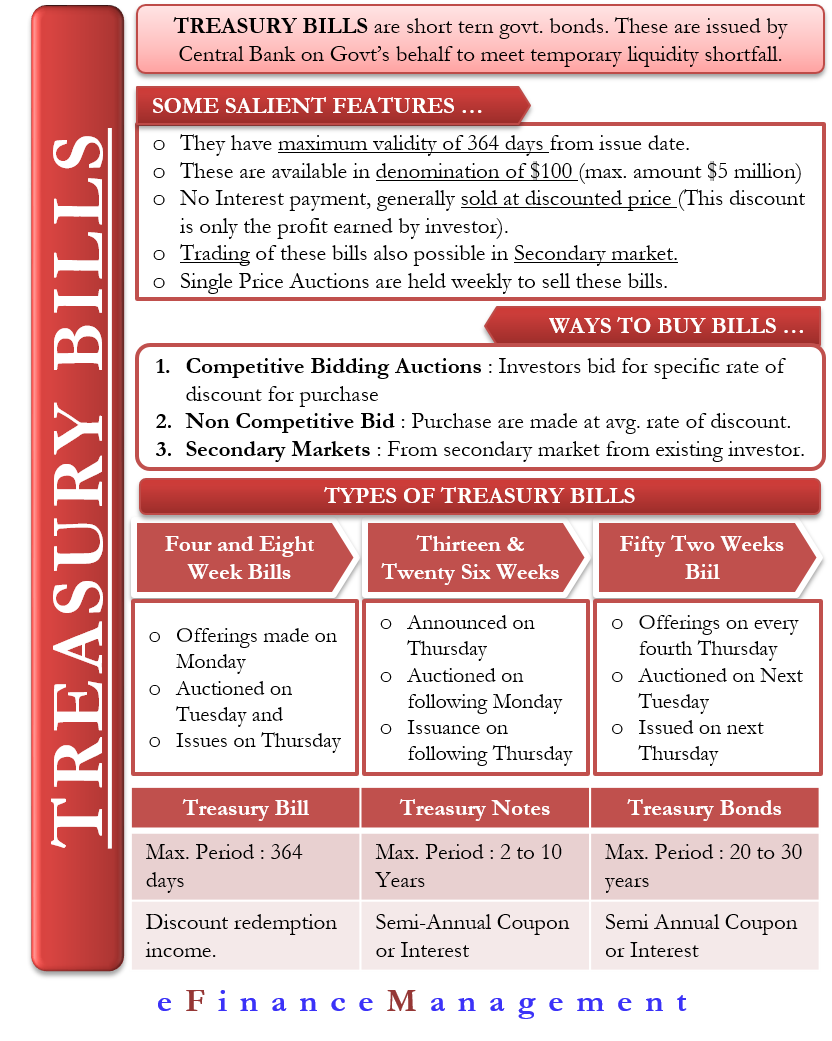

Treasury bills are normally sold in groups of $1000 with a standard period of either 4 weeks, 13 weeks, or 26 weeks.

How to buy a treasury bill. Backed by the u.s. Government — one of the most common ways people add them to their portfolio is. To open an account, you only need a u.s.

Government with no broker at treasurydirect.gov. You can purchase new treasury bills at auction directly from the u.s. Treasury bills have different maturity rates,.

Treasury bonds, notes and bills can be purchased for as little as $100 directly from the us treasury at the treasurydirect. (you can also buy series i savings. Choose the buy direct tab.

Go to your treasurydirect account. Submitting a bid in treasurydirect. The easiest ways to buy treasury bonds, notes and bills are directly from the u.s.

What is the safest investment in 2023? Government at treasurydirect.gov or through a broker. This online platform is the federal government’s main portal through which it can sell bonds.

Investors have options when it comes to buying treasurys. You can buy newly issued treasuries of various durations through your bank or brokerage, which may charge a commission, or you can buy them commission. Key points it’s a low minimum investment to buy treasury bills.

Learn how to buy treasury bills (bills) for terms ranging from four weeks to 52 weeks in electronic form through treasurydirect. Buying treasury bonds: For example, an investor may purchase a bill with a $1,000.

Click on the buydirect tab in the taskbar along the top of the website. Click the “products” tab and select “fixed income, bonds, and cds” from the dropdown menu.

![[StepbyStep Guide] How To Buy Treasury Bonds on Secondary Market From](https://www.mymoneyblog.com/wordpress/wp-content/uploads/2022/07/fid_tbond_sec1.gif)